Are you seeking a secure investment opportunity to safeguard and enhance your financial future? Augusta Precious Metals is the answer. If you’re considering investing in precious metals as part of your retirement plan, look no further than Augusta Precious Metals, the trusted partner you’ve been searching for. With a solid commitment to providing valuable insights and exceptional customer service, Augusta Precious Metals stands out as a leading company in the industry.

Through extensive research and careful analysis, we have evaluated various factors to identify the top players in the market. We aim to help you make an informed decision by comparing and contrasting the most reputable options. Join us as we explore the unique features and benefits that set Augusta Precious Metals apart as an ideal choice for investors seeking to preserve and grow their wealth.

Embark on an enlightening journey where precious metals, expert guidance, and financial prosperity converge with Augusta Precious Metals. Discover firsthand the advantages of investing with a company dedicated to helping you achieve your investment goals while safeguarding your dreams of retirement security.

Augusta Precious Metals is a prominent gold IRA company that allows investors to explore the world of precious metals, including gold and silver. Since its inception in 2012, under the leadership of CEO Isaac Nuriani, Augusta Precious Metals has gained recognition for its dedication to integrity and trustworthiness. The company focuses on serving precious metals IRA customers and individuals interested in purchasing gold and silver, solidifying its position as a leader in the industry.

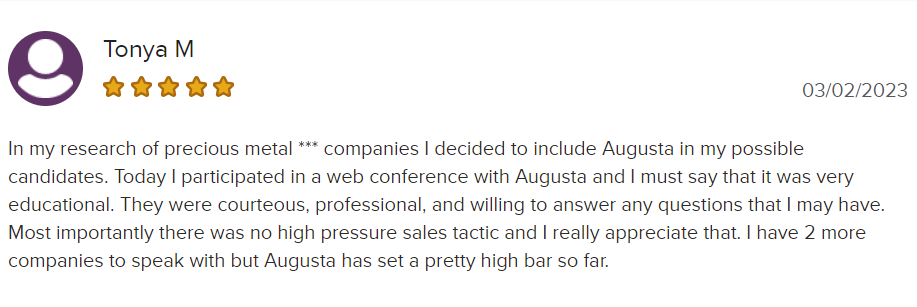

Its commitment to transparency and education sets Augusta Precious Metals apart from competitors. They offer a unique opportunity for the public to participate in a one-on-one Web conference with an economist who has been trained at Harvard University. This conference provides valuable insights into the realm of investing in precious metals.

Augusta advocates for consumers by guiding them through potential pitfalls associated with this industry. To further educate customers, they have created informative videos such as “Ten Big Gold Dealer Lies” and “15 Bad Reasons To Buy Gold,” which aim to help individuals make well-informed decisions.

Augusta Precious Metals distinguishes itself from competitors through various notable features. Let’s explore the exceptional qualities that make Augusta stand out in the precious metals industry.

Dedication to customer assistance: Augusta Precious Metals demonstrates unparalleled customer commitment by offering lifetime support and guidance. By partnering with Augusta, you gain access to a team of professionals devoted to assisting you in making well-informed investment choices.

Focus on education: Augusta Precious Metals goes the extra mile to educate its customers, ensuring they possess the knowledge and insights to navigate the intricate world of precious metals. Through valuable resources and educational materials, Augusta empowers investors, enabling them to make confident decisions.

Augusta Precious Metals has established itself as a renowned industry leader with its outstanding reputation and accreditations. The company has received an impressive 4.95-star rating based on over 930 reviews, demonstrating the trust and respect it has garnered from its clients.

Augusta Precious Metals holds an A+ rating on the Better Business Bureau (BBB), further solidifying its position as a reputable organization. This success can be attributed to the company’s expertise, commitment to providing quality products, and exceptional customer service.

On top of their IRA investment options, Augusta also lets you buy gold or silver bars directly.

When you establish a gold IRA account with Augusta Precious Metals, the company guarantees that you will receive assistance from a representative at every stage of the process, from opening the account to addressing any future queries.

Augusta covers your precious metals’ shipping fees and liability insurance until they’re safely delivered to the designated storage location.

The Internal Revenue Service (IRS) has approved certain coins and bullion to be included as investments in IRAs. Gold bars and coins must have a 99.5% or higher purity level. As for silver coins and bars’ purity level should be at least 99.9%.

Augusta highlights several gold coins available for purchase through your IRA account:

Silver coins you can purchase for your IRA that Augusta highlights include:

If you’re not keen on investing in an IRA or need to meet the $50,000 minimum requirement, Augusta Precious Metals provides a direct option for purchasing gold and silver products.

They offer an extensive selection of coins and bullion products outside an IRA. They provide complimentary shipping to any destination of your choosing.

Augusta Precious Metals provides a range of common gold and silver bullion items. You can find a comprehensive selection of these products on their website. It’s important to note that prices are unavailable online, so you must contact Augusta Precious Metals for confirmation when purchasing.

According to their transaction agreement, the margin for common bullion products can be as high as 5.2%. Once you have confirmed your order, the price will be locked in.

Besides common bullion, Augusta offers premium coins and other high-quality bullion products in gold and silver. The transaction agreement states that the margin for premium items may reach up to 66%. It’s worth mentioning that many of these premium products listed on their website are either limited in supply or already sold out.

Augusta Precious Metals, by the ever-changing gold and silver markets, doesn’t display product prices on its website. To obtain the price of a specific bar or coin, contact one of their agents via phone. The company doesn’t impose any management fees for gold and silver IRAs.

To initiate an IRA account with Augusta Precious Metals, one-time set-up fees amount to $250, which cover custodian and storage costs. In addition, a recurring annual fee of $200 covers custodian and storage costs.

Augusta Precious Metals determines buyback prices based on the intrinsic metal value of each product they offer. These buyback prices are subject to regular changes and may vary depending on whether the product is a common bullion or a premium item.

Investing in gold and other precious metals is often seen as a reliable strategy to protect against market fluctuations and inflation, which are significant concerns for retirees. However, it’s important to be aware of the risks involved.

While gold prices aren’t guaranteed to rise consistently, they don’t provide dividends. As a result, financial advisors typically suggest allocating only a small portion, such as 5% or less, of your investment portfolio to these assets.

Pros

Cons

Investors have long been drawn to precious metals such as gold and silver. These physical assets possess distinct characteristics and benefits, making them appealing additions to a diversified investment portfolio. Below are some of the primary advantages of investing in these valuable metals:

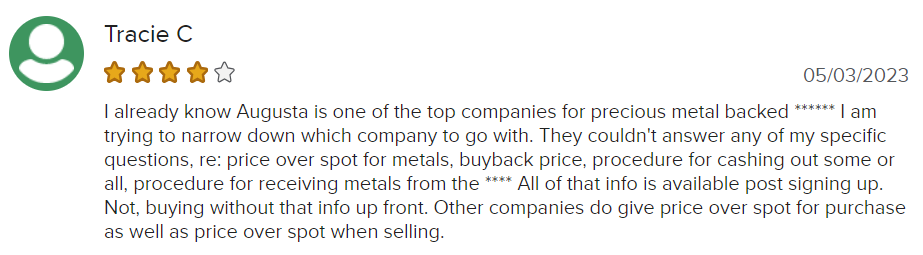

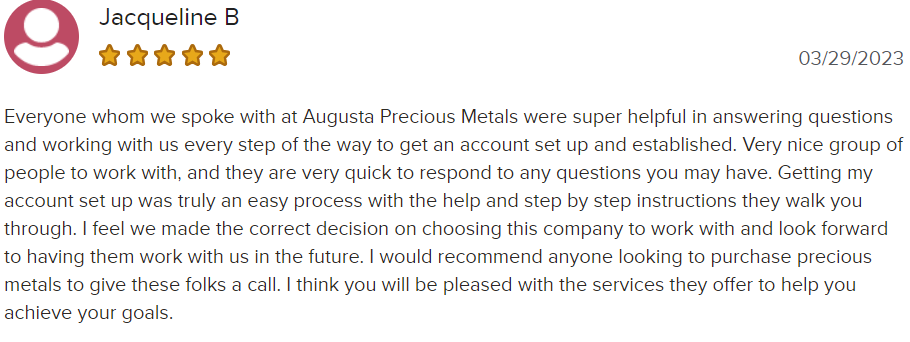

For responsible shoppers, it’s crucial to conduct extensive investigations on companies before making important choices like investing in valuable metals. This entails scrutinizing for any potential warning signs and assessing feedback from customers. Therefore, what can be inferred from the evaluations of Augusta Precious Metals?

Augusta Precious Metals Reviews has received an impressive BBB customer review rating of 4.97 out of 5 stars, with customers praising the company’s professionalism and dedication to providing educational resources.

Goldco is a well-respected, privately owned firm that specializes in gold IRA services and asset protection. With over ten years of experience, they have established themselves as one of the leading companies in the gold IRA sector. Goldco assists individuals with starting or transferring their gold IRAs, catering to various retirement plans that offer tax advantages.

They also provide direct sales of gold and silver, helping customers diversify their investment portfolios. Although fees are associated with the custodian for a gold IRA, Goldco doesn’t impose any additional charges.

Their customer satisfaction ratings are positive due to their exceptional customer service and comprehensive education center. Goldco stands out in the industry by prioritizing accurate information, building client trust, and providing ongoing support. Read our full Goldco review here.

American Hartford Gold is an esteemed company specializing in gold IRAs. They have a strong history of success and receive consistently high ratings from satisfied customers. Their services include precious metal IRAs, rollovers for gold and silver IRAs, and direct purchases of gold and silver bars or coins.

Investors can choose their investment options, with a minimum investment requirement of $5,000 for direct purchases and $10,000 for gold IRA rollovers. Equity Trust serves as their custodian, ensuring reliable management of assets. They offer secure storage solutions through trusted companies such as Brinks and Delaware Depository. Check out our complete American Hartford Gold review.

Oxford Gold Group is a well-known enterprise that focuses on helping people plan for retirement by offering precious metals IRAs. They provide expert advice and extensive services, such as buying physical gold, establishing Gold IRAs, and diversifying portfolios with silver, gold, platinum, and palladium.

The company places great importance on educating clients and ensuring their investments’ safety through trusted storage facilities like Brinks Depository and Delaware Depository. Although the ownership of Oxford Gold Group remains enigmatic, they strive to guide individuals who aspire to achieve a prosperous and diversified future during their retirement years.

While Augusta Precious Metals provides transparent pricing for gold, their payment options are limited. Only personal checks (up to $50,000) and bank wires are accepted as forms of payment. It’s important to note that all payments must be made over the phone, as online ordering is unavailable through Augusta Precious Metals.

Please keep in mind that the prices for your purchases will be finalized once your order has been confirmed and the gold dealer has received your payment. However, if you choose to purchase premium products, you may be eligible for lower prices through the 7-Day Price Protection Program. This program allows for price revisions, which can cause a reduced cost per ounce of gold.

Investors can transfer funds from their qualifying retirement accounts, such as IRA, Roth IRA, 401(k), and 403(b), to purchase metals that are eligible for IRAs. Augusta Precious Metals makes it easy for individual investors to transfer a portion of their current financial portfolio into an IRA by guiding company specialists throughout the process.

Once payment is made, the precious metals intended for gold and silver IRAs are transferred to a secure depository where they’re stored following IRS regulations. While monthly fees are associated with gold storage, this remains preferable since self-storage doesn’t offer IRA benefits.

Augusta Precious Metals stands out for its overwhelmingly positive reviews. With an exceptional rating of 4.96 out of 5 on BBB.org and zero complaints, this company consistently delivers top-notch customer service.

Augusta Precious Metals offers lifetime customer support and has flexible minimum investment requirements. They provide various educational resources and allow customers to purchase gold independently.

Investors can use gold IRAs to gain exposure to precious metals, but it’s crucial to diversify their investment portfolios. Augusta Precious Metals provides excellent educational resources and customer support, key factors in Money magazine’s recognition of the company as one of the top gold IRA options.

Augusta Precious Metals may be an excellent choice for individuals looking to expand their knowledge about the precious metals industry and make well-informed financial choices.

With the uncertain financial future, it's no surprise that investors are increasingly drawn to the captivating appeal of gold. However, is a Gold IRA a lucrative opportunity or a risky endeavor? In this blog article,...

Gold, a time-honored investment asset, has its fair share of proponents and detractors. Although opinions on its worth differ, it’s widely recognized that gold serves a distinctive purpose in financial markets to preserve value. While...

Investors have traditionally favored gold for precious metals, but there’s an alternative for those who prefer not to purchase physical gold. Gold Exchange-Traded Funds (ETFs) offer a more convenient and efficient investment option. Select the...

Gold has been a popular investment choice throughout history, protecting against various uncertainties like inflation, economic turmoil, currency fluctuations, and even times of war. When considering gold as an investment, it's essential not to limit...

Concerns about the economy and inflation persist among both experts and consumers as time goes on. Individuals increasingly seeking ways to safeguard their finances and adapt their investment strategies accordingly. Investing in gold is one...

Proper retirement planning is a crucial element in ensuring a stable financial future. It signifies the culmination of years of commitment, careful saving, and strategic investments, all aimed at achieving a comfortable and stress-free retirement....

When beginning the journey of building up your gold savings, one of the initial questions that arise is where to obtain physical gold. Thankfully, there are reputable Gold IRA companies such as Goldco and American...

Gold has always been a popular choice for investors throughout history. It safeguards against various uncertainties like inflation, economic instability, currency fluctuations, and even times of war. When considering investing in gold, it's essential not...

Silver IRAs, also known as precious metals IRAs or gold IRAs, enable individuals to secure assets backed by precious metals within their retirement accounts. Leading gold IRA firms typically offer a range of investment options,...

Envision a retirement in which your financial stability isn’t a source of uncertainty but rather a beacon of unwavering security, even in the face of economic turmoil. This high level of reassurance isn’t attainable but...

Gold has built a strong reputation over time as a dependable means of preserving value and protecting against economic uncertainties. For many years, it has been the go-to option for investors seeking to secure their...

If you have concerns about the future of your retirement savings and are contemplating converting your 401k to gold, facing no penalties, this guide is tailor-made for you. Given the increasing volatility of the market...

Securing a stable financial future and saving for retirement are of utmost importance, and an IRA account can serve as a valuable tool for achieving these goals. One viable option is the gold IRA rollover,...

Are you searching for a retirement investment option involving precious metals IRA? If so, you're lucky because we have the perfect guide. As the demand for these timeless treasures rises, we will explore the top-notch...

Are you seeking a secure investment opportunity to safeguard and enhance your financial future? Augusta Precious Metals is the answer. If you're considering investing in precious metals as part of your retirement plan, look no...

Are you considering investing in the American Hartford Gold Group? Are you in search of the ideal choice for your retirement plan? Look no further because this is where you'll find all the answers. We...

If you're searching for the best gold IRA company, Oxford Gold Group is worth considering. We understand the significance of making the right choice when selecting a company, and we’re here to provide valuable insights...

If you're searching for a secure investment option, Advantage Gold could be the ideal solution for safeguarding your retirement plan. We recognize the importance of choosing a reputable company for your investments and have extensively...

If you're searching for a secure investment option, look no further than Provident Metals. Our company specializes in helping individuals like you secure their retirement plans through strategic investments. We understand the importance of choosing...

If you're contemplating investing with Noble Gold Group and want to ensure it's the best choice for your retirement plan, you've come to the correct place. Choosing the perfect company to entrust your investments with...

If you're searching for a secure investment opportunity, look no further. Patriot Gold Group is the perfect choice for securing your retirement plan. We have valuable insights to offer and understand the importance of selecting...

Are you curious about whether Goldco is the ideal company for your investment goals? Well done, you've come to the correct destination. Accompany us on an enthralling expedition as we explore the intricacies of this...

If you're considering investing with Lear Capital and want to determine if it's the right choice for your retirement plan, this is the perfect place. We recognize the significance of choosing a dependable company for...

If you're contemplating Birch Gold Group as a potential choice for your retirement plan or investment, look no further. We recognize the importance of selecting the right company and are here to provide you with...

Privacy Policy | Terms and Conditions

This website provides general information and is not tailored to the specific goals of any individual. Please be aware that all investments carry inherent risks. When dealing with precious metals, it's important to understand that their prices may fluctuate, resulting in the potential for the value of your metals to increase or decrease over time. Consequently, you may sell them for more or less than your initial purchase price. Past performance should not be construed as a guarantee of future results. This website, while providing information on precious metals, does not make guarantees, assurances, or promises regarding future market movements, prices, or profits. It is essential to note that, despite our information on precious metals, we are not licensed financial advisors and do not provide financial advice. Furthermore, this website does not offer tax or legal advice and does not provide guidance on the tax or legal implications associated with buying or selling precious metals or establishing a Precious Metals IRA. For such services, individuals are strongly encouraged to seek consultation with qualified investment, legal, or tax professionals.

© Copyright 2024 Gold IRA Partners Gold IRA Partners. All Rights Reserved.